The International Textile Manufacturers Federation (ITMF) has published the results of the third study that investigated the effects of the coronavirus (covid-19) pandemic on the global textile industry. Between April 16-28, 2020, ITMF has conducted a third survey among ITMF Members and affiliated companies and associations about the impact the Corona-pandemic on the global textile value chain, especially on current orders and expected turnover in 2020. In total 600 companies from around the world participated.

ITMF 3rd survey: worldwide, current orders are down by -41% on average

According to the third survey, orders in East Asia dropped visibly less (-28%) than in all the other regions (-40% and more). It can be assumed that this region, which was hit first by the Corona-crisis, is also recovering first from it. Especially China and Korea were able to contain the epidemic successfully. In the last few weeks, most Chinese textile companies have ramped up production significantly. Likewise, off-line retail stores have reopened, and consumption is picking up again in East Asian countries. It remains to be seen what the consumption behaviour will be like in China, Korea and other places once shops are open again.

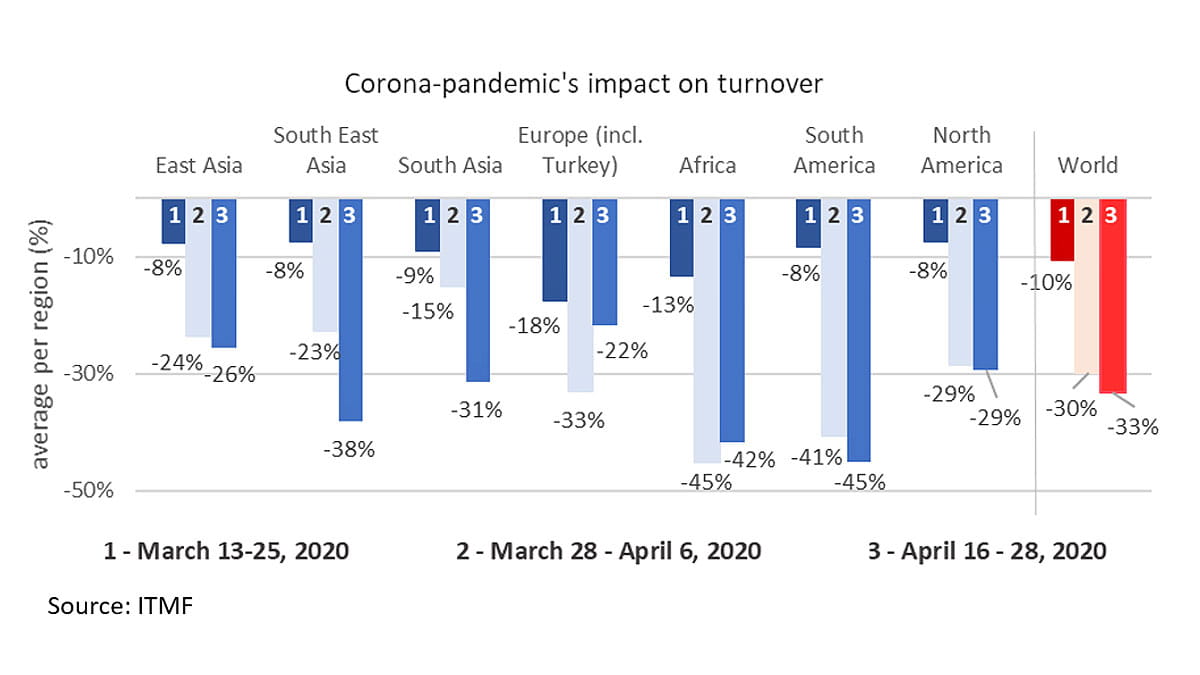

Worldwide, expected turnover 2020 is down by -33% on average compared to the previous year

Companies in Europe are expecting turnover in 2020 to be down by “only” -22%, a figure significantly better than the -33% reported in the second survey. Companies in East Asia are expecting turnover to be down by -26%, which is close to what was reported in the second survey (-24%). Companies’ turnover expectations in South East Asia and South Asia on the other hand have deteriorated significantly. These regions were hit later by the Corona-pandemic and hence the full impact was felt with a delay. Compared to 2019; expected turnover for 2020 is down to -38% in South East Asia and to -31% in South Asia. Turnover expectations in Africa, South America and North America have not changed much since the second survey and a 45%, 45% and 29% decrease expectation, respectively, arose.

Challenges and opportunities experienced altogether

The manufacturers participating in ITMF ’s survey describe the main difficulties they face such as; insufficient liquidity, disruption of the supply chain and uncertainty in the market. On the other hand, the following are the prominent opportunities in this period; increasingly thinking about diversification, currently focusing on medical textiles; streamlining organisation and production processes, accelerating the reassessment of existing supply chains, accelerating digitalisation and investing in sustainable production.

Government support was also addressed in the survey. Accordingly, several companies receive little or no help, even if governments have support policies. The support provided by the government to the textile sector includes; loans with low interest rates and deferred repayment, delayed tax payments; delayed social security payments, short-work schemes, reduction of power costs.

ITMF underlines that during this crisis, the greatest relief for the global industry will be achieved by; working in harmony with suppliers and manufacturers; rather than cancelling orders from retailers and brands unilaterally.